Here are some of the highlights. How the 2020 federal budget can benefit all charities Charities across Canada have been recommending that the government unlock more private wealth for public good.

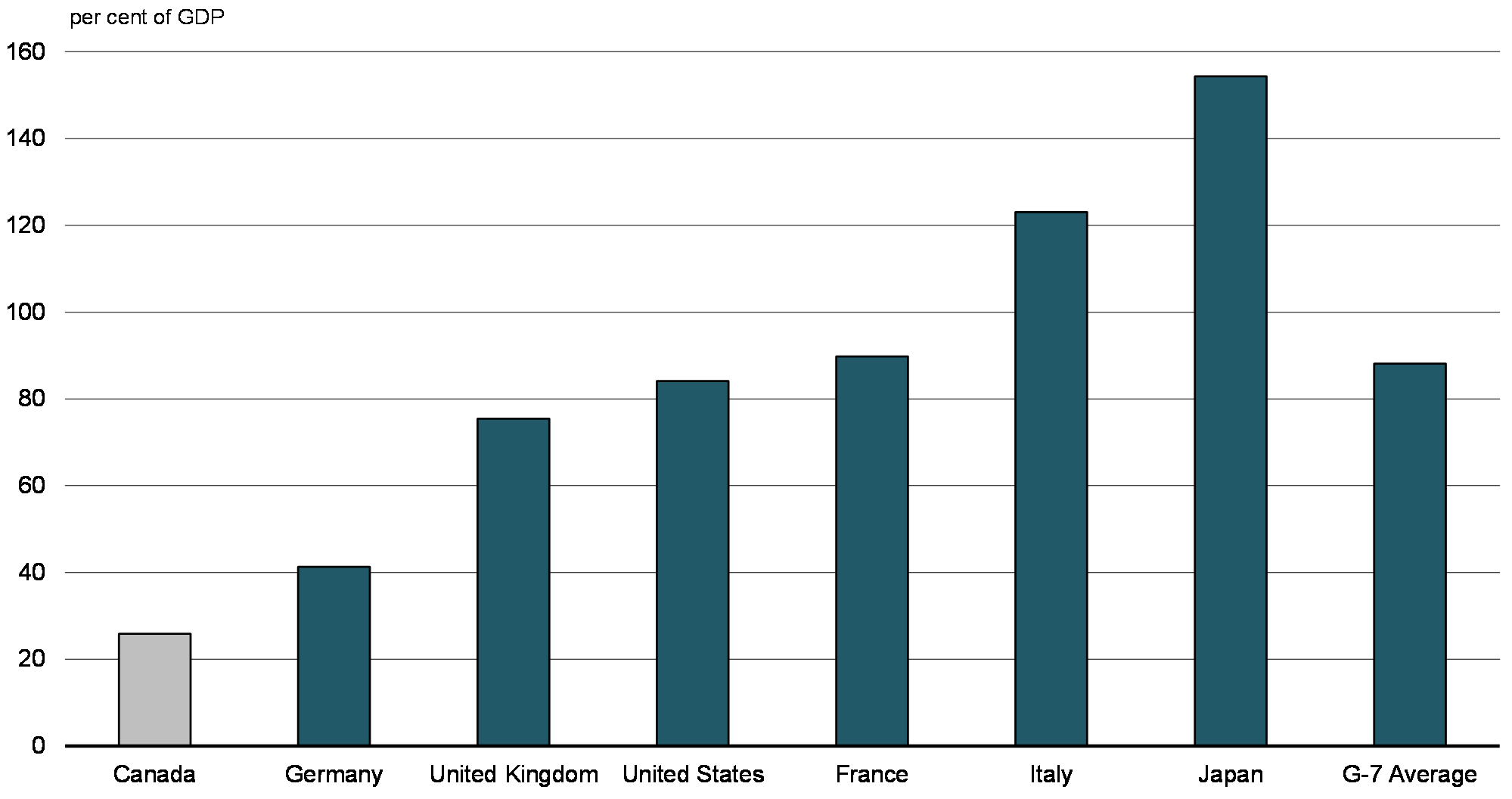

Who Pays And Who Receives In Confederation Finances Of The Nation

The budget said Canada needs green investments to exceed 125-billion.

Federal budget 2020 canada capital gains. Under Canadian tax law only 50 per cent of capital gains are taxable at your marginal rate. Currently the top federal tax rate of 33 per cent kicks in at income of more than 221708 for 2022. Investors thinking about selling taxable assets in the near term might consider acting before the federal budget is delivered.

Like many times in the last several years there is speculation that the capital gains inclusion rate will increase from 50 to 75. On March 22 2021 the Finance Minister Chrystia Freeland finally announced the date of the federal budget the Budget to be April 19th 2021. 6 hours agoOttawa will set up a 15-billion Canada Growth Fund to lure domestic and international capital to invest in the green economy.

Depending on your province of residence for high-income earners the marginal tax rate on capital gains in 2020 can be as high as 27 per cent. Gains inclusion rate may occur in the upcoming federal budget. After a long wait the Canadian government finally released their budget on April 19 2021.

On Potential Increase to Capital Gains Inclusion Rate. Schaufele for his part says he cant see the Liberals raising the capital gains rate in the 2020 budget. Spouses or common-law partners would continue to be able to split the value of the credit as long as the combined total does not exceed 1500 in tax relief.

But the Liberal government is. Election platform the NDP proposed to increase the capital gains inclusion rate. The budget didnt introduce a rate change but the.

Under Canadian tax law only 50 per cent of capital gains are taxable at your marginal rate. Realize capital gains is. The 2022 federal budget will probably include initiatives to curb speculation in real estate boost productivity through targeted tax incentives and promote overall tax fairness tax policy experts suggest.

The capital gains tax of course is only a concern if you hold appreciated investments in a non-registered account. As the tables below for the 2019 and 2020 tax years show your overall taxable income determines which of. Budget 2022 proposes to double the HBTC amount to 10000 which would provide up to 1500 in tax relief to eligible home buyers.

To 75 from 50. For now we are all patiently waiting for the Federal Government to announce any changes during the 2021 federal budget announcement. Alberta - February 27 2020.

The federal budget date. In total Budget 2022 proposes to provide up to 38 billion in support over eight years on a cash basis starting in 2022-23 to implement Canadas first Critical Minerals Strategy. The document has been permanently moved.

Manitoba - March 19 2020. 5 hours agoThis years federal budget has a variety of tax measures affecting individuals corporations and charities. The news release that accompanied the Proposals.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Newfoundland and Labrador - September 30 2020. Awaiting bank surtax details.

New Brunswick - March 10 2020. This has Canada speculating again if a hike to the capital. There has been much anticipation and speculation regarding the upcoming Budget as the previous budget was.

Feb 7 2022. And as it turns out high-income earners pay the majority of capital gains tax. By wilkinson February 21 2020 Comments Off.

Depending on your province of residence for high-income earners the marginal tax rate on capital gains in 2020 can be as high as 27 per cent. There are always predictions about what tax changes will be included in the federal governments annual budget. Until then you and your professional tax advisors should discuss whether or not it is worth planning and strategizing in advance to hopefully minimize capital gains taxes in the future.

Sometimes referred to as fiscal. British Columbia - February 18 2020 Read more. Investment firms increasing crypto exposure.

For the two years leading up to it the biggest question was whether the Liberals would introduce higher taxes either as a wealth tax an increase to the capital gains rate or potentially do away with the principal residence exemption on the sale of your home. 0 15 or 20. This will create thousands of good jobs grow our economy and make Canada a vital part of the growing global critical minerals industry.

1 day agoFederal budget will complicate Bank of Canada inflation fight. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal BudgetThe Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA. The enhanced rate will gradually be phased out beginning in 2024 until it eventually expires in 2028.

For the 2020 tax year there is a 883384 lifetime capital gains exemption on the sale of certain types of businesses particularly qualified. Long-term capital gains are usually subject to one of three tax rates. Upcoming Federal Budget April 19th Planning For Possible Capital Gains Tax Increase.

To make the first 50-basis-point hike to the policy interest rate since 2000 as they work to bring consumer price gains down from a three-decade-high. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. On March 2 2020 Finance announced it will propose a temporary enhanced first-year capital cost allowance CCA rate of 100 for qualifying zero-emission off-road automotive vehicles and equipment.

301 Moved Permanently. The government also stated it will revisit the rules governing the taxation of employee stock option deductions in the upcoming budget changes the government first proposed last year.

Income Tax 2020 Changes Every Canadian Needs To Know Income Tax Income Tax Return Tax Return

Who Pays And Who Receives In Confederation Finances Of The Nation

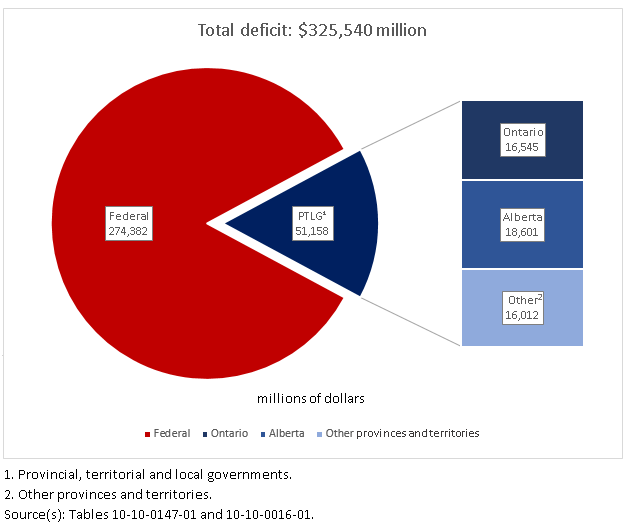

Annual Financial Report Of The Government Of Canada Fiscal Year 2019 2020 Canada Ca

The Daily Consolidated Canadian Government Finance Statistics 2020

Comments